The War for Talent: Hedge Funds vs Big Tech

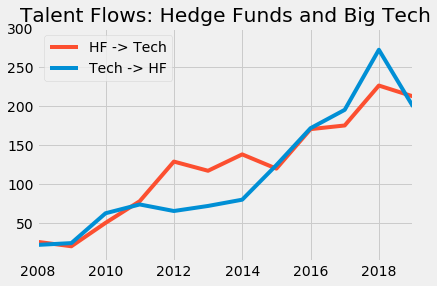

We’re seeing a rise in transitions between hedge funds and tech

Skilled mathematicians, physicists, and computer scientists have long been coveted by top hedge funds and big tech companies. For years, these sectors have competed over this technical talent pool to generate profitable trading algorithms, build infrastructure, and targeted ad platforms. But commentary on this war for talent has been little more than conjecture. Who is actually winning the war to attract top talent - top hedge funds or big tech?

Using our workforce intelligence data to track the transitions of top talent between the biggest hedge funds and the biggest tech companies, we’re able to see who is recruiting more from whom, and winning the race in this high-stakes war for talent:

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

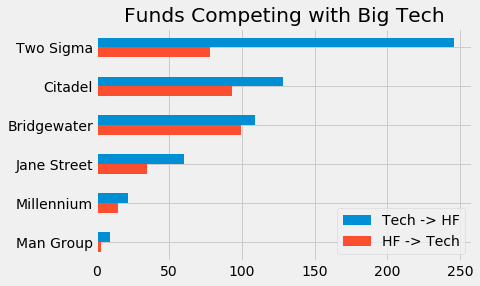

To dive deeper, below are the specific trends of the hedge funds that are leading the resurgence:

Takeaways:

- While for years big tech companies and hedge funds did not exchange talent with each other, more recently, there has been a notable uptick in industry crossover, according to our workforce intelligence data.

- Hedge funds began as the most attractive place for top talent but have fallen behind from 2012 to 2014. They have since recovered their edge against big tech from 2015 onward. Since 2019, however, we’re seeing big tech catching up.

- Two Sigma is leading the charge in recruiting and retaining top tech talent from tech companies.

If you have any ideas of other metrics to track or would like to hear more about Revelio Labs workforce intelligence data, please feel free to reach out to us. You can also check out our other two most recent newsletters here and here.